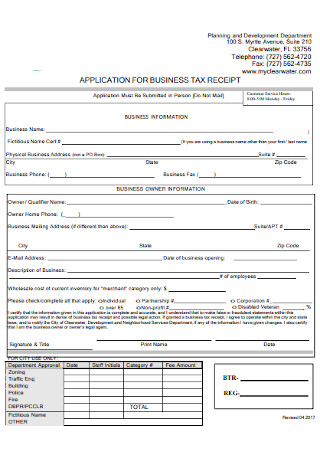

Some variables include the number of employees, equipment, and seating capacity. Failure to renew a BTR subjects the business owner to delinquent fees.īTR fees are dependent on the nature of the business.

#BUSINESS RECEIPTS CODE#

Any person who maintains a permanent or temporary business location or branch office within the City, for the privilege of transacting or engaging in or managing any business, profession, or occupation shall be required to pay a business tax pursuant to Chapter 8 of the Code of Ordinances.In some cases, if a business performs several functions or has multiple locations, it may be necessary to obtain more than one BTR for that business. Business owners can create a public user account to link active BTRs and stay up to date on your BTR.Īny person or business engaging in business activity within city limits, including one-person companies and home occupations, must obtain a City Business Tax Receipt (BTR) to operate. View your BTR status and pay fees online through eTRAKiT.Chapter 6: Contractors and Contractors' Regulatory BoardĮnsures that all contractors and vendors doing business in the City are properly licensed under applicable City and State regulations and investigates alleged violations of local, state, and regional codes and ordinances.The following links take you to the chapters of the City Code which pertain to the guidelines, fees and penalties relating to engaging in or managing any business, profession or occupation. Please complete the appropriate forms and mail to: * For information on choosing a contractor, click here.īusiness Tax Receipts Home/Commercial Business Licensing Frequently Asked Questions (Spanish Version).Criteria for Property Maintenance Business Tax Receipt (Spanish Version).Criteria for Property Maintenance Business Tax Receipt.Licensing / Business Tax Receipts General Information

#BUSINESS RECEIPTS UPDATE#

#BUSINESS RECEIPTS SOFTWARE#

On the main page of the software click on 'Contractors' for Contractors or 'Licenses' for businesses.

You can search for contractors through the eTRAKIT software on the City website. FAX 23.Įmail questions to Licensing/Business Tax Division at: for Businesses or Contractors

When a business, profession or occupation requiring a Business Tax Receipt is started after the first quarter of a fiscal year, the Business Tax Receipt will be computed on a quarterly basis.Ĭontact Code Compliance at (239) 574-0430 for required receipts and fees. All Business Tax Receipts shall be sold beginning July 1 of each year, and are due and payable on or before September 30 of each year, and shall expire on September 30 of the succeeding year. Preliminary Subdivision Plans and PlatsĪ Business Tax Receipt (BTR) is required for every person or persons engaging in or managing any business, profession or occupation.īusiness Tax Receipts shall be issued by the Code Compliance Division.Site Development Plans and Subdivision Construction Plans.Inspection Information & Permit Related Contact Information.Planning Division Applications and Documents.Customer Service-Permitting Contact Information.

0 kommentar(er)

0 kommentar(er)